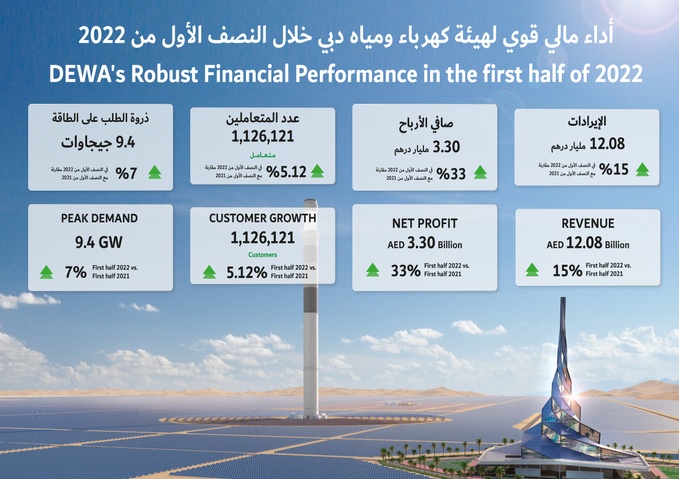

Dubai Electricity and Water Authority PJSC (ISIN: AED001801011) (Symbol: DEWA), the Emirate of Dubai’s exclusive electricity and water services provider, which is listed on the Dubai Financial Market (DFM), today reported its second quarter 2022 financial results, recording quarterly revenue of AED 7.01 bn and net profit of AED 2.61 bn. For the first half 2022, DEWA’s revenue is AED 12.08 bn and net profit is AED 3.30 bn.

Robust financial performance

DEWA’s first half revenue increase of 15% to AED 12.08 bn was mainly driven by an increase in demand. Energy demand in Dubai during the first half of 2022 increased by 6.3% compared to the same period in 2021. Demand for energy in the first half of 2022 reached 23.27 TWh compared to 21.9 TWh in the first half of 2021. Nearly 10% of this generation is from Solar. Similarly, water demand in the same period grew by 6.4%.

DEWA’s peak demand in the first half of 2022 was 9.4 GW, which represents a 7% increase over the same period of last year.

By the end of the second quarter, DEWA served 1,126,121 customers, representing a 5.12% increase from the same time last year.

DEWA’s majority owned subsidiary, EMPOWER, also demonstrated record growth in segmented revenue and profit. In the first 6 months of the year EMPOWER’s revenue was 1,154 million AED and net profit was 432 million AED, representing a 16% and 11% increase respectively versus the same period in the last year.

Quote

“DEWA’s half year financial results demonstrate our commitment to advancing strategic priorities of sustainability focused smart growth, enhanced customer happiness, operational excellence and attractive capital returns for our shareholders. Continued focus on project delivery, innovation and accelerating our digital transformation has bolstered our results through the first six months of 2022. We maintain significant capacity to deploy capital through a disciplined investment strategy with a focus on meeting the aspirations of the Emirate of Dubai. In line with our strategy, we continue to provide a robust infrastructure to keep pace with rapid developments in Dubai and provide our services to more than a million customers according to the highest standards of availability, reliability, efficiency, and safety,” said HE Saeed Mohammed Al Tayer, MD & CEO of DEWA.

“We continue to implement pioneering projects to diversify Dubai’s clean and renewable energy sources and achieve our wise leadership’s vision for a bright and sustainable future for generations to come,” added Al Tayer.

Select quarterly and half year highlights

In the first half of 2022, DEWA’s installed capacity increased by 700 megawatts (MW) to 14,117 MW. This includes 600 MW from the Hassyan Power Complex, which runs on natural gas and 100 MW from the 5th phase of the Mohammed bin Rashid Al Maktoum Solar Park (“MBR Solar Park”), which runs on photovoltaic (PV) solar panels. MBR Solar Park is the largest single-site solar park in the world, built on the Independent Power Producer (IPP) model, with planned capacity of 5,000 MW by 2030.

By June 2022, DEWA’s 250 MW pumped-storage hydroelectric power station, which is being constructed in Hatta, was 44% complete. It will have a storage capacity of 1,500 megawatt-hours and a life span of up to 80 years. This is the first power station of its kind in the GCC. In addition, DEWA achieved 85% completion of its 120 MIG Nakhali water reservoir, 84% completion of its 60 MIG Lusaily Reservoir, and 11% completion of its 120 MIG Hassyan Reservoir.

Further, DEWA also commissioned 287 (11kV) substations in Dubai in the first half of 2022. There are now 78 (33kV) substations in service and 42,093 Medium Voltage (11kV) substations in the company's transmission and distribution network. The company also commissioned 1 (400kV) substation and 10 (132kV) substations, bringing the total to 26 (400kV) substations and 329 (132kV) substations. DEWA also completed laying 100 Km of 132 kV cable and 802 Km of medium voltage cable.

DEWA continues to improve its overall efficiency by adopting the latest smart technologies and innovative practices across all its services and operations.

In June 2022, DEWA launched an Automatic Smart Grid Restoration System (ASGR), the first of its kind in the MENA region, to increase the control, management, and monitoring of its power network. The system works round the clock without any human intervention. It uses a smart, innovative, and central system that locates the fault in the power network, isolates it and automatically restores the service. This improves grid automation, fault detection and retrieval of connections.

In the second quarter of 2022 and as part of the Smart Living initiative, DEWA added a Self-Assessment tool for residential customers to easily understand their consumption patterns. This is part of DEWA’s effort to make Dubai homes more sustainable and efficient. Since inception, the Smart Living Initiative service saved up to 8 billion gallons of water.

DEWA is the first utility worldwide to use nano satellites to monitor and improve the operations, maintenance and planning of its electricity and water networks. In May 2022, DEWA signed an MoU with Eutelsat, the French global satellite operator, to provide technical support for DEWA’s Space-D programme and DEWA’s 3U nanosatellite DEWA-SAT1. This will help develop nanosatellite Internet of Things (IoT) terminals and enhance connectivity between DEWA’s assets and its nanosatellite. In addition, DEWA pro-actively harnesses the use of drone technology, using advanced drones for asset inspection purposes to support Dubai’s growing infrastructure.

In April of 2022, DEWA launched the ‘Dubai EV Community Hub’ website for Dubai, aiming to increase electric vehicle (EV) adoption by centralising information regarding EV developments in Dubai www.dubaievhub.ae. Currently, DEWA provides a robust charging infrastructure for electric vehicles across Dubai with over 334 charging stations.

DEWA has won three Global Excellence Assembly Awards in the first half of 2022. These are the Excellence in Innovation Award, the Business Innovation Award and the Outstanding Customer Service Award. Also, DEWA won the Globe of Honour Award for Environment and the Sword of Honour for Health and Safety from the British Safety Council in the second quarter of 2022.

EMPOWER IPO under review

DEWA is currently reviewing the possibility of an IPO of its majority owned subsidiary, Emirates Central Cooling Systems (“EMPOWER”). The timing and size of the same are under study and are subject to all the necessary approvals.

Reiterate our dividend policy

DEWA reiterates its dividend policy and expects to pay a minimum dividend of AED 6.2 billion per year over the next five years. The dividends are intended to be paid twice each fiscal year in April and October. The first dividend payment of AED 3.1 billion is expected to be made in October 2022.

Key Financial Metrics

7,009

|

6,129

|

14%

|

12,077

|

10,533

|

15%

|

2,611

|

1,904

|

37%

|

3,301

|

2,482

|

33%

|

0.048

|

0.034

|

41%

|

0.063

|

0.045

|

40%

|

The full second quarter earnings announcement can be found at: https://www.dewa.gov.ae/en/investor-relations

or https://www.dfm.ae/en/issuers/listed-securities/securities/company-profile-page?id=DEWA

For investor relations, please contact: dewainvestors@dewa.gov.ae

For media, please contact: media@dewa.gov.ae

About Dubai Electricity and Water Authority PJSC

DEWA was created in 1992 as a result of the merger of the Dubai Electricity Company and the Dubai Water Department. DEWA is the exclusive electricity and water utility provider in Dubai. The Group generates, transmits and distributes electricity and potable water to end users throughout Dubai. DEWA owns 70% of Empower, currently the world’s largest district cooling services provider by connected capacity, and owns, manages, operates and maintains district cooling plants and affiliated distribution networks across Dubai. The Group also comprises a number of other businesses including Mai Dubai, a manufacturer and distributor of bottled water, Digital DEWA, a digital business solutions company, and Etihad ESCO, a company focused on the development and implementation of energy efficient solutions.

To find out more, visit http://www.dewa.gov.ae

Cautionary statements relevant to forward-looking information

This news release contains forward-looking statements relating to DEWA’s operations that are based on management’s current expectations, estimates and projections about the energy industry and other relevant industries that DEWA operates in. Words or phrases such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “forecasts,” “projects,” “believes,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,” “may,” “could,” “should,” “will,” “budgets,” “outlook,” “trends,” ”guidance,” “focus,” “on schedule,” “on track,” "is slated,” “goals,” “objectives,” “strategies,” “opportunities,” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this news release. Unless legally required, DEWA undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.